Introduction to Catch Up Depreciation

Have you owned a commercial building for several years? If so, you might be missing out on significant tax savings. A cost segregation study can unlock valuable depreciation deductions, even for older properties. This process, often referred to as “catch-up depreciation,” allows you to claim additional depreciation for past years, significantly reducing your tax liability in the current year.

How Does Catch-Up Depreciation Work?

- Identify Eligible Assets: Any commercial building that has been in service or remodeled since December 31, 1986, can benefit from a cost segregation study.

- Conduct the Study: A qualified professional will analyze your building’s components, assigning shorter depreciation lives to qualified assets like wiring, plumbing, and HVAC systems.

- Calculate Catch-Up Depreciation: The difference between the depreciation you’ve already taken and the depreciation you could have taken with a cost segregation study is your catch-up depreciation.

Form 3115 and the 481(a) Adjustment

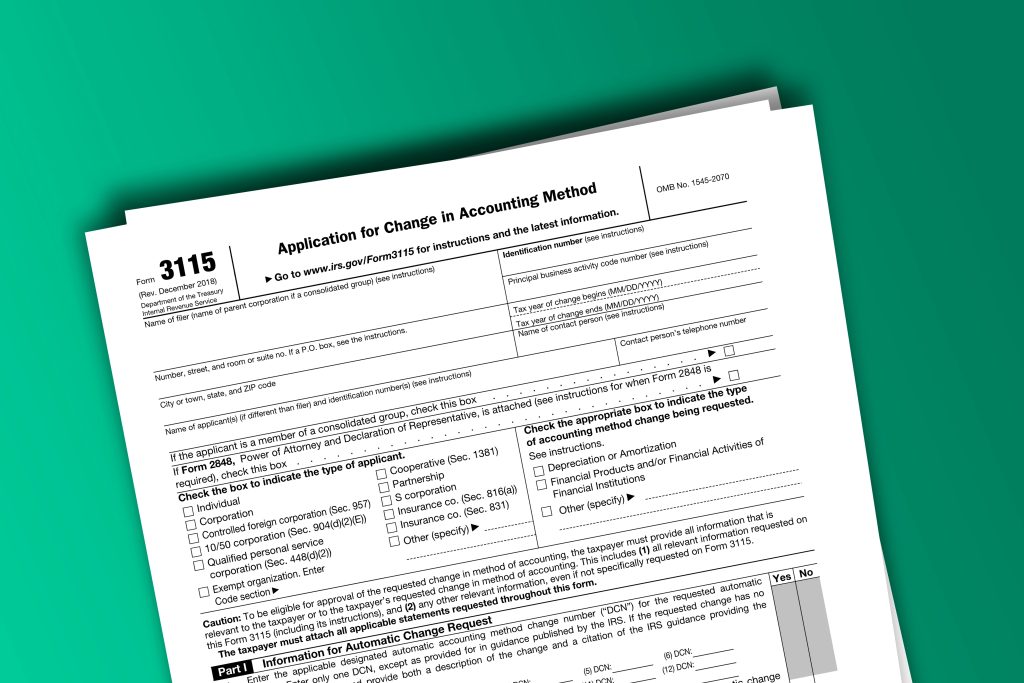

To claim this catch-up depreciation, you’ll need to file Form 3115, Application for Change in Accounting Method. This form allows you to change your depreciation method to reflect the results of the cost segregation study.

A crucial part of this process is the 481(a) adjustment. This adjustment allows you to claim the difference between the depreciation you’ve already taken and the depreciation you could have taken if the cost segregation study had been applied from the beginning.

How to Calculate the 481(a) Adjustment:

- Determine Past Depreciation: Calculate the total depreciation you’ve claimed on the building since it was placed in service.

- Calculate Potential Catch Up Depreciation: Determine the depreciation you could have claimed if the cost segregation study had been applied from the start. This involves assigning shorter depreciation lives to qualified components like wiring, plumbing, and HVAC systems.

- Calculate the Difference: Subtract the past depreciation from the potential depreciation. The result is the 481(a) adjustment, which you can claim as an additional deduction in the current tax year.

Key Benefits of Cost Segregation Studies:

- Significant Tax Savings: Maximize your depreciation deductions and reduce your tax liability.

- Improved Cash Flow: Increase your cash flow by deferring taxes.

- Simplified Tax Compliance: Streamline your tax reporting process.

Are you ready to unlock the potential of your commercial property? Contact us today to learn more about cost segregation studies and how they can benefit your business.