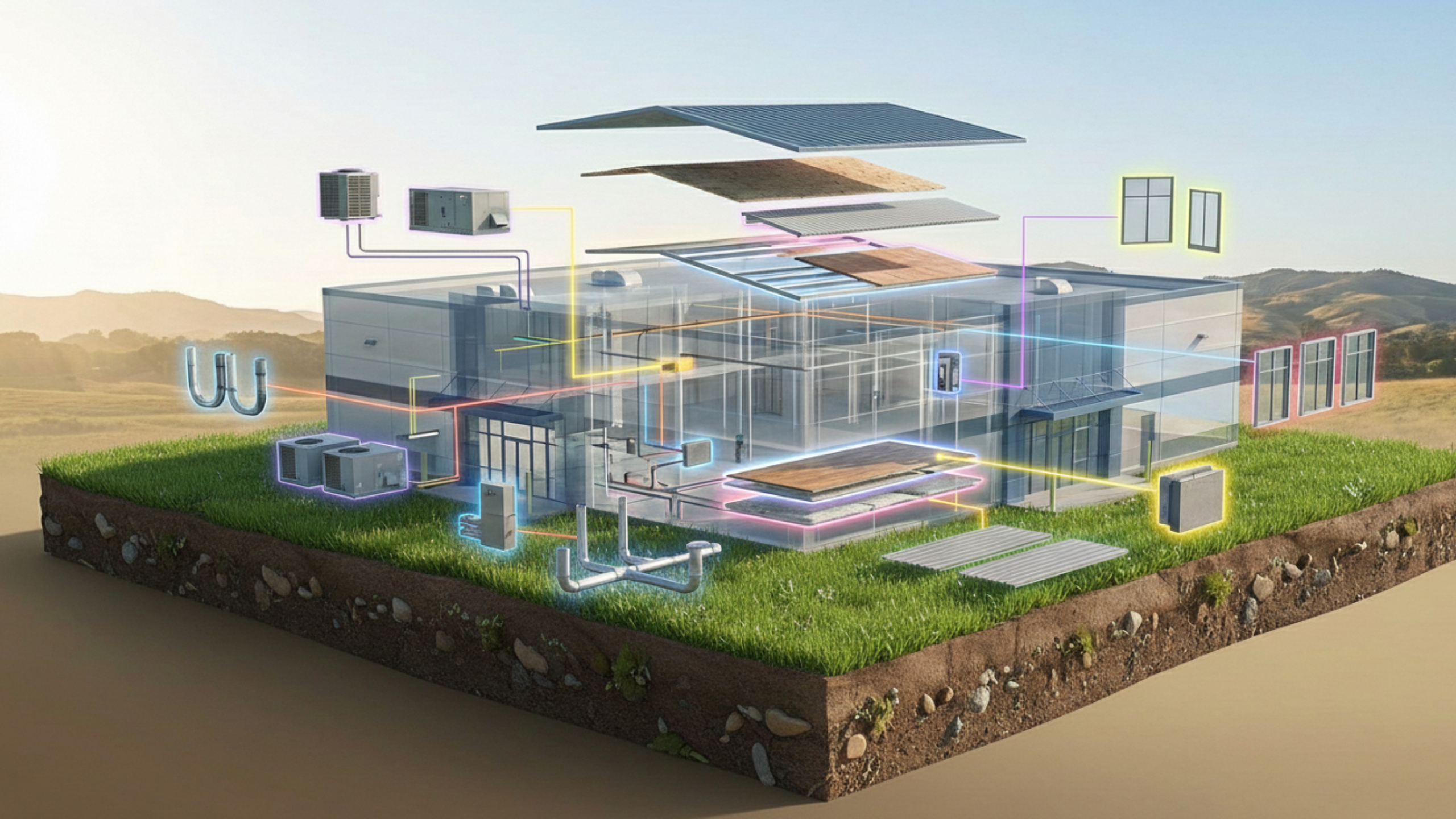

When commercial property owners consider a cost segregation study, one of the first questions that arises is: “What portion of my investment qualifies for accelerated depreciation?” The answer begins with a fundamental principle in tax law; land is not depreciable. Understanding how land value affects your cost segregation study is essential to setting realistic expectations […]

Read MoreUnderstanding Land Value in Cost Segregation: What Property Owners Need to Know