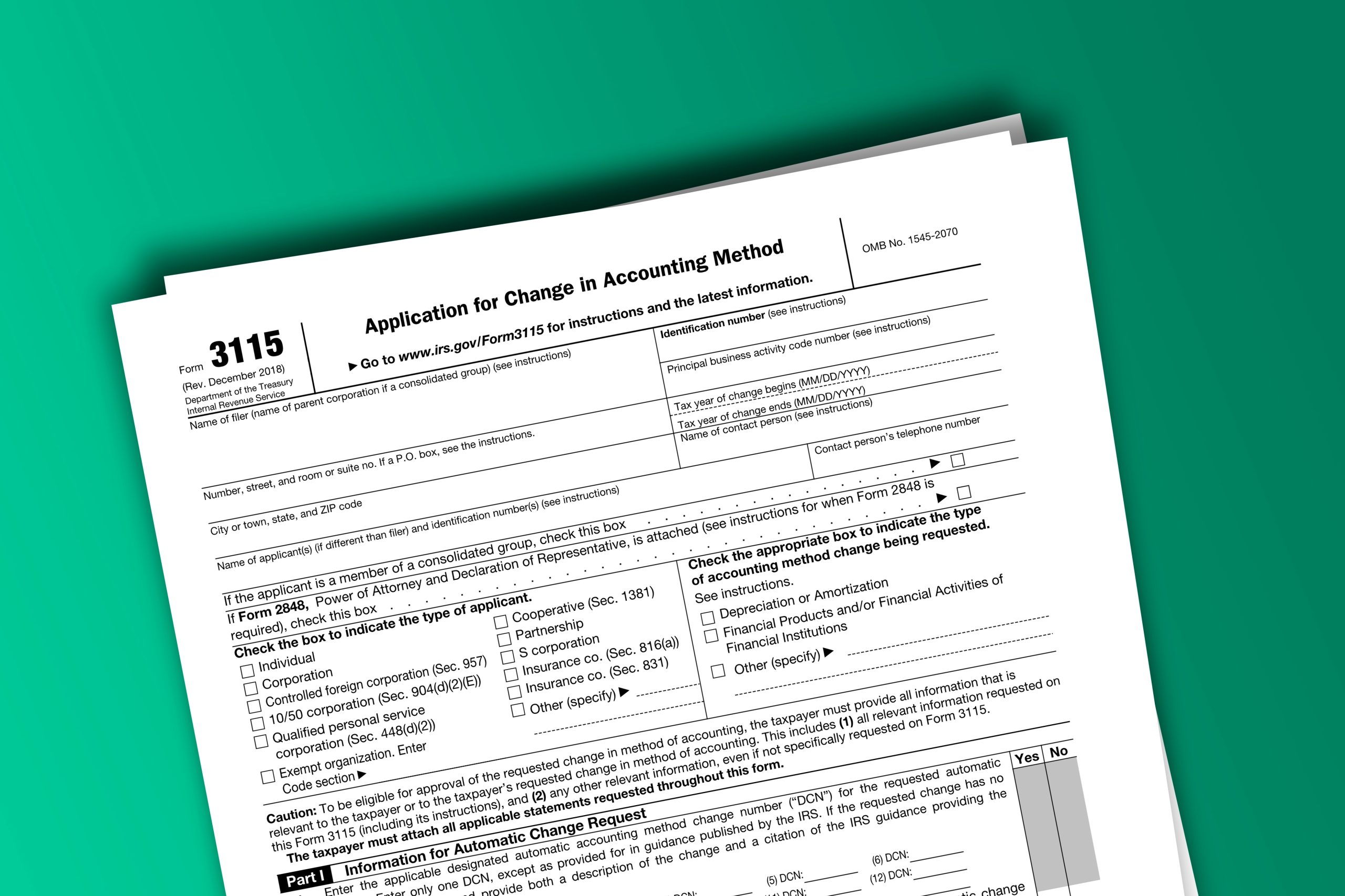

Understanding federal tax rules for your home can save you thousands. This guide covers the key deductions, exclusions, and strategies every homeowner should know. What Does Owner Occupied Mean for Federal Tax Purposes Owner-occupied means you live in the property as your primary residence. The IRS typically requires you to: This distinction determines which tax […]

Read MoreOwner-Occupied Federal Tax Rules: Complete Guide for Homeowners