Section 179D Deduction

Qualify for substantial tax deductions through energy-efficient building design and renovations. Available to building owners, architects, and designers, 179D deductions can yield up to $5.81 per square foot when your building exceeds ASHRAE standards. Perfect for commercial buildings, multi-family properties, and industrial facilities.

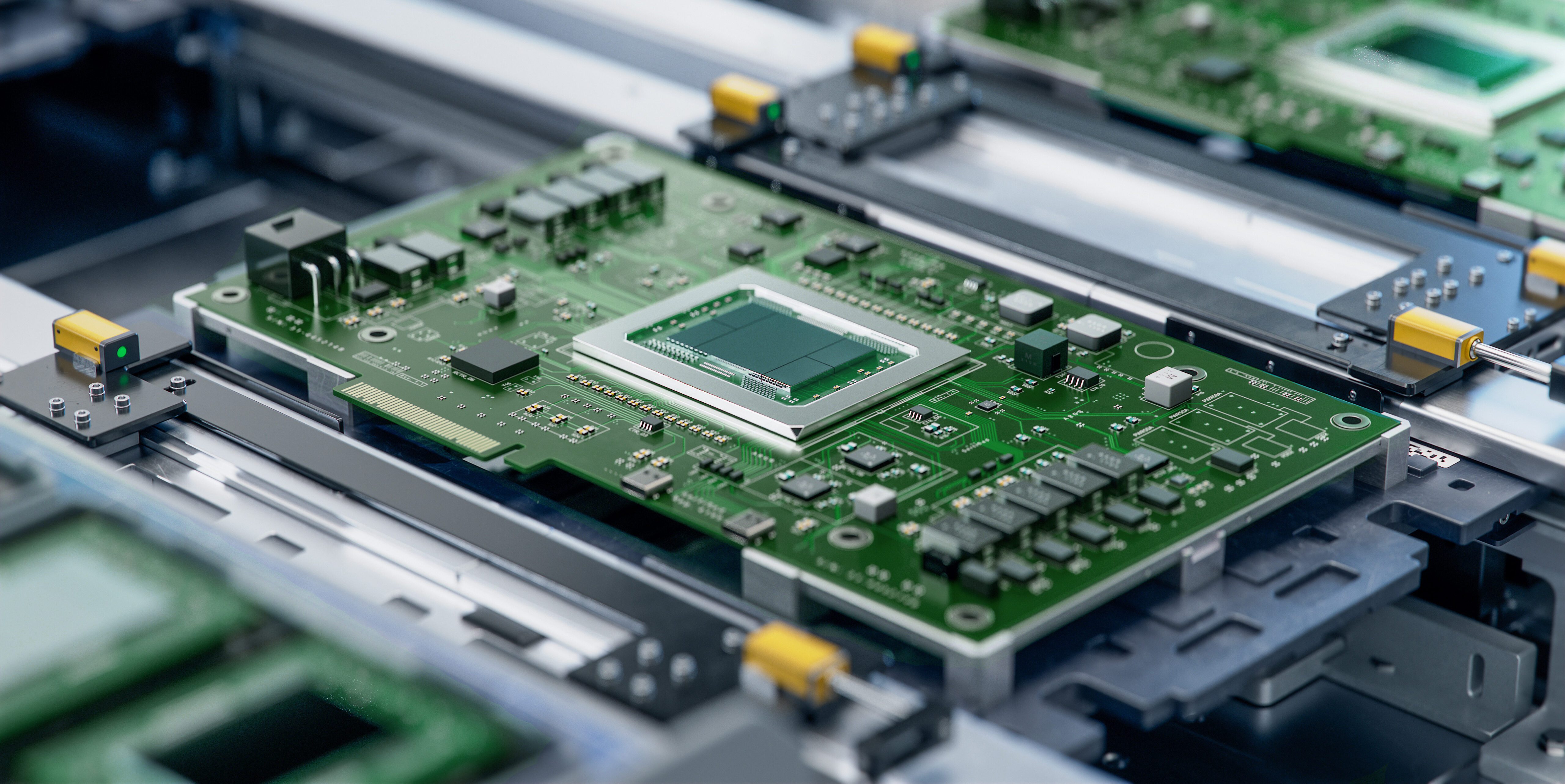

R&D Tax Credits

If your business conducts ongoing research and development to drive improvements in your products or operations, you could qualify for a dollar-for-dollar reduction in your tax liability. Our experts help identify qualifying activities across industries – from manufacturing and software development to agriculture and construction.

Cost Segregation

Accelerate depreciation and boost cash flow through our engineering-based cost segregation study. We help property owners identify assets eligible for shorter depreciation periods, resulting in significant tax savings. Our studies have delivered $30K-$80K in savings per $1M in building costs for over 50,000 properties nationwide.

Green Zip Tape

Maximize tax benefits while advancing sustainable construction through innovative development solutions. This patented system allows for moveable and reusable partitions, qualifying for accelerated depreciation while reducing construction waste and earning LEED credits.